Execution & Slippage: Why ‘Tight Spreads’ Isn’t Everything

January 2, 2026

The main method for brokerage firms to attract clients is by offering “tight spreads.” Traders are conditioned to seek the smallest possible difference between bid and ask prices. Traders view it as the best measure of cost-effectiveness. But, narrow spreads are often hide execution & slippage quality.

However, focusing solely on spreads is a risk management oversight. A narrow spread is merely a quote. It does not guarantee the price at which a trade will be executed.

Understanding execution & slippage is essential when examining market liquidity intricacies, latency principles, and slippage’s mathematical impact on the “Effective Spread.”

The Anatomy of the Spread: Quote vs. Reality in Execution & Slippage

The spread represents the visible cost of a transaction. In a frictionless market with infinite liquidity, the spread would be the only cost. However, the spread displayed on trading platforms is frequently just a “suggested” price.

Market Maker (B-Book) Brokers:

- These brokers may advertise a 0.0 pip spread to attract clients, but often lack the internal liquidity to fulfill larger orders at that price, resulting in added “markups” during execution.

ECN/STP ((Straight Through Processing) or (Electronic Communication Network) Brokers:

- When a trader places an order, if the broker operates as an ECN or STP provider, the order is sent to a liquidity pool comprising tier-one banks and various liquidity providers.

Only the “Top of Book” (TOB) reflects the tightest spread, typically applicable only to the smallest trade sizes. As order sizes increase, traders move deeper into the order book, where spreads widen.

How Slippage Works: Understanding What Slippage Is in Forex

What is slippage in forex? Slippage refers to the discrepancy between the anticipated price at which a trade should be executed and the actual execution price. This occurs in the milliseconds between order transmission and matching engine reception.

Bad Slippage:

- When the market moves unfavorably during execution, or if liquidity is insufficient at the requested price, negative slippage occurs. For instance, a “Buy” order may be filled at a higher price than intended.

Good Slippage:

- In a high-quality execution environment, positive slippage can occur, allowing limit orders to be filled at better prices than expected. It’s crucial to select brokers that provide “price improvement.”

If a broker consistently enforces negative slippage without offering positive slippage, they impose an extra cost on the trader beyond the quoted spread.

Latency: The Physical Limit on Trading and Order Execution Speed

Execution & slippage quality is dictated by latency. This results from the distance between a trader’s computer, the broker’s server, and the liquidity provider’s matching engine. Order execution speed is critical for minimizing slippage.

- – Network Latency: The time required for data to travel through fiber-optic cables.

- – Processing Latency: The duration it takes for the broker’s software to verify margin, evaluate risk, and transmit the order.

In fast-moving markets, a 100-millisecond delay can lead to significant price shifts. Thus, a broker with a 0.1 pip spread and a 200ms execution delay may ultimately be more costly than a broker with a 0.5 pip spread and a 10ms delay.

The “stale quote” dilemma means that by the time the order reaches the exchange, the desired price may no longer be available.

“Eating the Book” and Depth of Liquidity

Retail traders typically assess spreads based on standard lot sizes (100,000 units). However, institutional and high-volume traders must consider market depth.

Example Scenario:

- If a broker offers a 0.2 pip spread for EUR/USD, it could be misleading if liquidity providers only have 1 million units available at that price.

If a trader wishes to buy 5 million units (50 lots), the first million will be filled at 0.2 pips, but the rest will be filled at less favorable prices. This scenario is referred to as “eating the book.”

A broker with a wider Top of Book spread but deeper liquidity can provide a better VWAP than a “thin” broker with a 0.0 pip spread that vanishes with larger orders.

Types of Execution: A-Book, B-Book, and Hybrid Models

The broker’s business model significantly influences the tight spread fallacy and impacts execution & slippage:

- – Market Makers (B-Book): These brokers profit when traders lose. They offer “fixed” or “ultra-tight” spreads to draw in customers but may introduce fake delays or requotes.

– Understanding requotes vs slippage is essential: When a market moves favorably for the trader, they might not execute at the requested price, compelling acceptance of a worse price (“Requote”).

- – ECN/STP (A-Book): These brokers funnel orders to external liquidity providers, earning from spreads or commissions. They lack incentives to tamper with execution quality. In this model, spreads may widen during major news events, revealing a clearer market depiction.

Choosing a B-Book broker for a 0.0 pip spread often results in higher “hidden taxes” due to frequent requotes and poor fill rates, especially in volatile markets.

The Equation for Hidden Costs: Spread vs Commission Forex

To discern the true cost of a trade, consider more than just the spread. When evaluating spread vs commission forex models, the total execution cost per trade is defined as:

Total Cost = (Spread × Lot Size)+ Commissions + (Slippage × Lot Size)+ Swap/Financing

For example, with a 0-pip spread but losing 1.5 pips on every entry and exit, your real cost amounts to 3.0 pips per round turn.

In contrast, a professional ECN broker with a 0.5 pip spread and 0.1 pip slippage may yield a total cost of only 1.2 pips per round turn.

The “cheap” broker can result in an excess of 1,800 pips in lost equity over 1,000 trades.

Rates of Fill and Rejection in Execution & Slippage

Fill rate, the percentage of orders executed at requested prices or better, is vital for execution & slippage quality. Reputable brokers maintain fill rates exceeding 98%.

However, “Tight Spread” brokers often exhibit high rejection rates during significant market changes (e.g., NFP reports, central bank decisions).

If orders are rejected when spreads are tight, the spread’s attractiveness diminishes, as access to the market is inhibited until volatility subsides.

Types of Orders and Execution Quality: Market Order vs Limit Order Forex

A broker’s execution engine can be evaluated by how it manages various order types. Understanding market order vs limit order forex strategies is crucial for optimizing execution & slippage:

- – Market Orders: Prioritize speed over price, with slippage often prevalent.

- – Limit Orders: Focus on price, granting traders fills at their desired price or better. Quality brokers tend to provide positive slippage on these orders.

- – Stop Orders: Convert into market orders upon price triggers. In volatile markets, stop-loss executions may occur several pips away from the intended trigger price.

Brokers offering Guaranteed or Negative Slippage Protection Stops typically present wider spreads to balance the risk involved. Understanding this trade-off is crucial, as there are no “free” risks in a decentralized market.

The Importance of Technical Infrastructure for Execution & Slippage

Savvy traders seek brokers that invest in robust infrastructure rather than marketing gimmicks, focusing on:

- – Cross-Connectivity: A VPS located in the same data center as the broker’s execution engine (e.g., Equinix LD4 in London) can reduce latency to under 1 millisecond.

- – Price Aggregation: Brokers sourcing quotes from over 20 liquidity providers typically experience more stable execution than those relying on a single prime-of-prime feed.

With multiple liquidity providers, brokers can offer “Internal Crossing,” enabling the matching of simultaneous buy and sell orders, facilitating instant fills without slippage.

Conclusion:

A fixation on tight spreads indicates superficial trading practices. To cultivate a sustainable trading business, prioritizing execution & slippage consistency is vital.

When choosing a broker, look at the average slippage for order fills, the latency for transaction times, the market depth for stable spreads on bigger positions, and make sure they are open and honest by giving you detailed execution reports.

In the long run, traders save more by opting for brokers with superior technology and liquidity, even with slightly higher spreads. It’s rather than chasing “zero-spread” illusions that vanish upon order placement.

Join VT Affiliates. This platform is a CFD broker platform designed for affiliates aiming to maximize earnings. Affiliates can earn up to 80% of the spread and benefit from over $10 million in monthly payments.

Frequently Asked Questions (FAQs)

- What is the difference between the quoted and effective spreads?

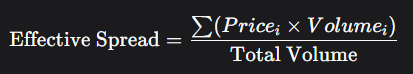

The quoted spread is the displayed price difference, while the effective spread reflects the actual cost after incorporating slippage and fees.

- Why does slippage occur with “zero-spread” accounts?

Latency and market volatility contribute to slippage, as prices can fluctuate during the milliseconds needed for order transmission to the broker’s server.

- How does market depth impact fills?

If your order exceeds available volume at the best price, the broker fills the remainder at succeeding prices, typically worse than the initial on. This is termed “eating the book.”

- Is slippage always negative?

No. While negative slippage incurs costs, positive slippage (price improvement) results in better entry or exit prices.

- Why do spreads widen during news releases?

In times of high volatility, liquidity providers withdraw offers to mitigate risk, leading to increased bid-ask gaps.

- Does server location impact performance?

Yes. Proximity reduces latency, and utilizing a VPS in the same data center as the broker minimizes delays and potential price changes during execution.

- Which is superior: STP/ECN or Market Maker?

STP/ECN brokers submit orders to the broader market, enhancing transparency and execution & slippage quality, whereas Market Makers counteract trades internally.

- How can I evaluate my broker’s execution quality?

Monitor three crucial metrics: fill rate (order execution percentage), average slippage (in pips), and execution speed (in milliseconds).