How Forex Affiliates Measure ROI Across Channels

December 1, 2025

What makes a struggling affiliate different from a top-tier partner? It’s not talent; it’s learning how to measure ROI across channels that counts.

Stop risking and wasting your marketing budget. Don’t run ineffective Facebook ads and send out poor email blasts. You need solid marketing data.

This guide will equip you with methods to track, measure, and enhance your returns, ensuring that every dollar counts.

Why Monitoring ROI Across Channels is Crucial

Many new affiliates mistakenly believe everything is fine when they see their total commission. However, multi-channel Forex affiliate marketing can be complex.

For instance, you might be earning $5,000 a month. However, if your expenses amount to $4,800 in ads, your actual profit is minimal.

Analyze your Return on Investment (ROI) by channel. From here, you can identify the platforms that attract high-value traders from those that merely drain your budget.

Key Benefits of Monitoring ROI

- – Identify High-Value Sources: Discover which channels bring in traders that deposit significantly more, even if certain platforms drive high traffic.

- – Effective Budgeting: Allocate funds wisely by eliminating ineffective channels and investing in those that perform well.

- – Scalability: You can only scale efficiently if you can assess performance. Accurate tracking allows you to confidently invest more in high-converting ads.

Essential Metrics for Evaluating Forex Affiliate Marketing ROI

Simply tracking sign-ups isn’t sufficient for accurate ROI assessment. In Forex, a sign-up is meaningless if the customer doesn’t engage in trading. Hence, you must monitor specific metrics to gauge the effectiveness of your traffic.

Important Metrics to Track

- – Cost Per Acquisition (CPA): How much you spend (on ads or content) to acquire one active trader.

- – Earnings Per Click (EPC): Understand the profitability of your different traffic sources.

- – Conversion Rate: The ratio of clicks that convert into funded accounts; top professionals might enjoy rates of 5% or higher with targeted traffic.

- – Customer Lifetime Value (CLV): Crucial for Revenue Share models, as a trader’s ongoing activity is worth much more than a one-time deposit.

- – Return on Ad Spend (ROAS): Evaluate how much revenue each dollar spent on ads generates for your paid campaigns.

Tip: Focus not just on clicks but on funded accounts. A thousand clicks with zero deposits yield poor ROI.

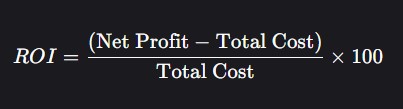

Simple ROI Calculation Across Channels

You don’t need complex math to evaluate your returns. Use this straightforward formula:

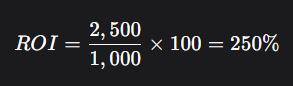

Example Calculation Using Google Ads:

Suppose you executed a Google Ads campaign for a broker like VT Affiliates:

- – Total Cost of Ads: $1,000

- – Total Commissions Made: $3,500

- – Profit after Expenses: $3,500 −$1,000 = $2,500

Now, applying the ROI formula:

In this scenario, you earn $2.50 for every $1 spent, indicating a favorable ROI for Forex affiliate marketing. If your calculation yields a negative number, consider halting the campaign or improving your landing page promptly.

Strategies for Multi-Channel Forex Affiliate Marketing

Successful affiliates generally don’t depend on a single traffic source. Diversifying your approach mitigates risks associated with algorithm changes across different channels.

1. SEO (Search Engine Optimization)

- – Cost: Time-intensive content creation but low monetary investment.

- – Potential ROI: High long-term return; organic traffic often converts better, as users actively seek solutions (e.g., “best MT4 broker for scalping”).

- – Strategy: Concentrate on high-value keywords like broker reviews and comparisons.

2. Pay-Per-Click (PPC) Advertising

- – Cost: Higher upfront costs.

- – ROI Potential: Quick results; however, profits may be lower due to ad expenditures.

- – Strategy: Monitor and optimize landing page conversion rates to avoid paying for clicks that don’t convert.

3. Social Media and Influencer Marketing

- – Cost: Variable; can include paid ads or investment of time.

- – ROI Potential: High traffic, but visitors may not engage as deeply as with SEO.

- – Strategy: Use engaging videos to demonstrate how to navigate the broker’s platform.

Benefits of Forex Affiliate Tracking Software

For affiliates with multiple clients, manually tracking ROI across channels is impractical. Advanced tools come into play here.

Leading affiliate programs from premium brokers offer built-in dashboards. Meanwhile, many professionals utilize third-party Forex affiliate tracking software to consolidate data.

What to Look for in Tracking Tools

- – Sub-ID Tracking: Attach unique tags to each link (e.g., link?id=facebook_ad_1) to ascertain which ad resulted in a sale.

- – Real-Time Reporting: Access to clicks and conversions as they happen, rather than delayed feedback.

- – Pixel Integration: The ability to send data back to Facebook or Google upon conversion, enhancing algorithm performance.

Comparing CPA vs. Revenue Share Forex Affiliate Programs

The commission structure you choose significantly impacts your ROI. Should you opt for the one-time payment (CPA) or ongoing percentage (Revenue Share)?

The best option depends on your traffic sources and immediate financial needs.

CPA (Cost Per Acquisition) vs. Revenue Share

| Feature | CPA | Revenue Share |

| Payment Structure | One-time payment per trader. | Ongoing percentage of spread or commission. |

| Cash Flow | Immediate, ideal for ad funding. | Slower start, builds passive income over time. |

| Risk Level | Low risk; paid upon trader qualification. | High risk; income ceases if trader stops trading. |

| Best Channels | Paid ads (PPC) and social media. | SEO, educational content, and community engagements. |

| ROI Horizon | Short-term (immediate returns). | Long-term (valuable over time). |

Which to Choose?

For paid ads, CPA tends to be safer, providing immediate cash flow to reinvest. However, if you’re an educator or an IB focused on community building, Revenue Share may yield greater ROI over 12 to 24 months.

Enhancing Forex Affiliate Conversion Rates

Attracting traffic to your site is only half the battle. To maximize ROI, you must convert visitors into active traders.

Forex affiliate conversion rate optimization (CRO) involves small improvements to your funnel to extract greater value from every visitor.

1. Conversion Rate Optimization Techniques:

- – Ensure Landing Page Consistency: If your ad promotes “Low Spreads on Forex,” direct users to a dedicated landing page on trading forex rather than a generic homepage.

- – Utilize Social Proof: Display reviews or screenshots of withdrawal proofs (where permitted) to foster trust.

- – Highlight Platform Features: Serious traders prioritize tools, so emphasize that the broker supports MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

2. Leveraging MT4 and MT5 for Client Retention

Retention is vital for optimizing ROI. Collaborate with brokers offering MT4 and MT5, which are industry standards.

Why These Platforms Matter for Your ROI:

- – User Familiarity: Most experienced traders prefer dependable MT4 over proprietary platforms.

- – Automation Features: Expert Advisors (EAs) are compatible with MT4 and MT5, leading to higher trading volume and prolonged activity, thereby enhancing your Revenue Share earnings.

- – Cross-Device Compatibility: These platforms offer seamless transitions between desktop and mobile, increasing the likelihood of frequent trading by your referrals.

You need to promote brokers that utilize robust platforms. As such, you reduce client churn and increase Customer Lifetime Value (CLV).

FAQs About Measuring Affiliate ROI

1. What constitutes a good ROI for Forex affiliate marketing?

A good standard in affiliate marketing is a 12:1 return (1,200%). For Forex, especially with high CPA payouts (e.g., $500 or more), ROI can often surpass this if sourced from SEO.

2. How can I track conversions across multiple channels?

Employ UTM parameters or “Sub-IDs” for each traffic source to differentiate links. Your broker’s dashboard can help identify which link generated a commission.

3. Is paid traffic effective for Forex affiliates?

Yes, but it requires careful management. You need a high-converting funnel, especially since keywords like “Forex trading” can be expensive. Many affiliates prefer niche keywords, such as “EURUSD scalping strategy.”

4. Can I shift between CPA and Revenue Share models?

Many high-quality broker programs, such as VT Affiliates, offer hybrid options or allow negotiations to determine which model suits your traffic best.

5. Why is my conversion rate low?

Common issues include directing traffic to a generic homepage, promoting unregulated brokers, or lacking sufficient trust signals within your content.

Conclusion

To achieve the substantial earnings enjoyed by top-tier affiliates, you must be data-driven. Therefore, you need to accurately track your ROI across channels.

Eliminate the guesswork and build a reliable business model capable of sustainable growth.

Join VT Affiliates. Our affiliate programs provide the optimal MT4/MT5 trading environment, advanced tracking tools, and competitive CPA and Revenue Share structures necessary to maximize your conversions.